Downside of Preferred Shares

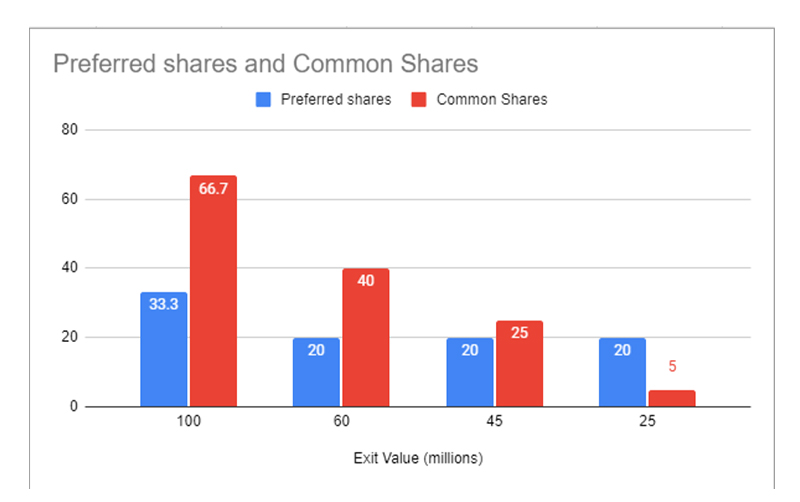

The vast majority of minority investments come in the form of preferred shares. What is a preferred share? Simply put it is a share class with a “preference”. In the case of institutional investors the preference is at minimum a simple liquidity preference. That means they get 100% of their paid in capital before common shares receive their portion. This does not impact the common shares unless the business is sold below the valuation of the investment. The chart below take a hypothetical scenario where a SaaS business has raised $20m at a $60m post money valuation or $40m pre-money. Which means the common stock holds 2/3s of the equity and the preferred stock holds 1/3. This could be a business that has just $5m in ARR given recent frothy valuations. Let’s assume four exit scenarios at $100m, $60m, $45m and $25m. As you can see any exit scenario below the valuation the investment round the common stock takes all the downside. If the $5m ARR business growth slows and only grows to $10m with a $25m exit, the preferred stock gets 80% of the proceeds ($20m) vs. its 33% ownership at investment. Now in less frothy times preferred stock can come with additional preferences such as an an compounding 8% coupon or a minimum 1.5x or 2x value on exit. The latter scenario can be very punitive to the common shares on exit potentially reducing their value to $0. I have seen this happen.

My view are preferred shares can be seen as convertible debt with an option on the upside. Founders should value not their common stock at the same value as the preferred stock. They may believe they have only sold 1/3 of the business, but that is not really true. It depends on the exit. It’s almost a conditional valuation vs. a true valuation for common equity. Whereas investors are willing to limit their upside (with a high buy in price) with downside protection as a trade off. Conversely founders can hold a greater percentage of the upside but potentially lose some or all of the value of their common stock. My view are founders are either not fully aware of the risks or simply don’t take them seriously. They are just happy to get a deal done and get back to running their company.

Both Firmex and LUMIQ chose to do common stock rounds at a more modest valuation. This is unusual for minority investments. However, this way both investor and founder have the same economics, risks and upside. Why would founder(s) want to risk wiping out their equity just to stretch on valuation? If the business is successful you are going to make a lot of money anyway, and if they business is not, at least you can walk away with something versus nothing. Investors should be willing to take the risk if they are buying at a reasonable price and truly believe in the business. Further, all shareholders are better aligned in good times and bad.